Back

17 Aug 2023

Crude Oil Futures: A deeper drop looks not favoured

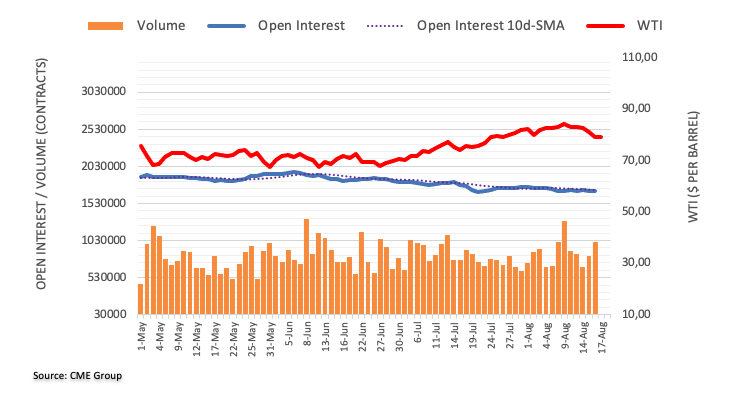

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions for the second session in a row on Wednesday, this time by around 10.8K contracts. On the other hand, volume added around 188.5K contracts to its previous daily build.

WTI: Gains remain capped by $85.00

WTI prices extended the weekly leg lower and broke below the key $80.00 mark per barrel on Wednesday. The marked downtick was amidst shrinking open interest, however, bolstering the idea that a sustained decline seems out of favour for the time being. On the upside, the 2023 peak near $85.00 emerges as quite a decent resistance for bulls so far.