UK services PMI preview: What to expect of GBP/USD?

The UK economy will release its November services PMI later in the European session at 0930GMT, which is forecast to tick lower from October’s 54.5 to 54.2 last month.

A weaker PMI print is likely to stall the recovery in the GBP/USD pair, sending it back towards 1.26 handle, while a positive surprise may offer much-needed respite to the GBP bulls, sending the rate back beyond 100-DMA located at 1.2725.

Analysts at TD Securities noted, “The post-Brexit bounce took the services PMI up to its highest level since Jan, but we think that strength may be a bit more overdone and we look for the PMI to settle around current levels while uncertainty around Brexit remains so high.”

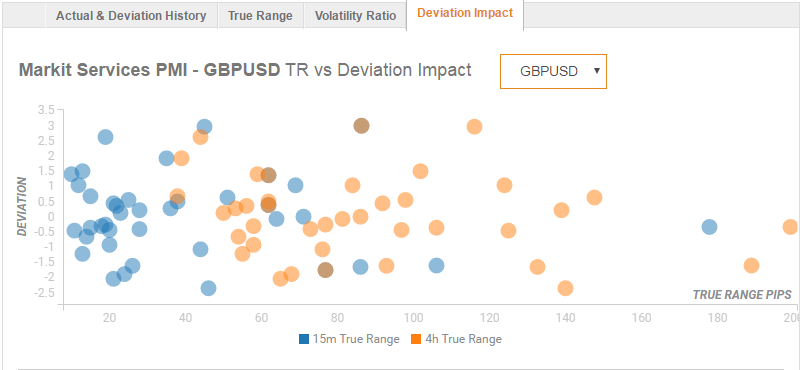

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 45 pips in deviations up to 2.5 to -2, although in some cases, if notable enough, a deviation can fuel movements of up to 70 pips.

GBP/USD Technical Levels:

Haresh Menghani, Analyst at FXStreet notes, “With short-term technical indicators moving into bullish territory, renewed strength above 1.2700 handle, marking 50% Fibonacci retracement level of 1.3439-1.1980 downslide, leading to a subsequent move above 1.2735-40 two-month high resistance, the pair seems all set to dart towards 100-day SMA resistance near 1.2800 handle before heading towards an ascending trend-channel resistance near 1.2835-40 region.”

"On the downside, weakness below session low support near 1.2625 level now seems to find strong support near 1.2600 handle, which if broken is likely to accelerate the slide immediately towards 38.2% Fibonacci retracement level support near 1.2535 area en-route 50-day SMA support near 1.2450 region with 1.2500 psychological mark acting as intermediate support.”