Back

22 Mar 2019

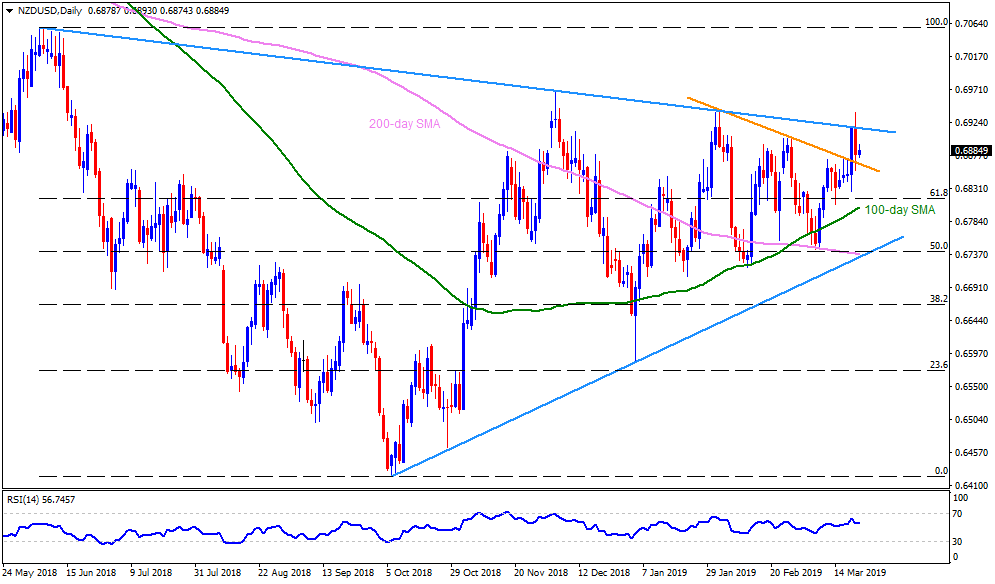

NZD/USD Technical Analysis: Bulls keep an eye over 0.6920 resistanceline

- NZD/USD is on bids around 0.6890 during early Friday.

- The quote took a U-turn from nine-month-old descending trend-line on Thursday but is still above previous resistance turned support figure of 0.6860, making it capable of aiming a break over 0.6890 for one more time.

- In doing so, 0.6940 and 0.6970 can please buyers ahead of challenging them with 0.7000 round-figure.

- If at all Kiwi optimists surpass 0.7000 mark, 0.7060 can be their next target.

- Meanwhile, a downside break of 0.6860 might not hesitate visiting 0.6825 and 61.8% Fibonacci retracement of June – October decline, at 0.6815, but 100-day simple moving average (SMA) level of 0.6800 could limit further south-run.

- During the pair’s extended downturn past-0.6800, 0.6790 and 0.6770 can entertain sellers ahead of highlighting the 0.6740-35 support confluence that comprises 200-day SMA, five-month-old ascending trend-line and 50% Fibonacci retracement.

- Assuming the pair’s slid under 0.6735, bears can recall 0.6705 and 0.6650 on the chart.

NZD/USD daily chart