Back

5 Apr 2019

EUR/JPY Technical Analysis: 125.90/126.00 resistance-confluence can question bulls

EUR/JPY daily chart

- EUR/JPY trades near 125.40 ahead of the European markets open on Friday. The quote has been on a recovery mode from 123.60 and is likely heading towards 125.90/126.00 resistance-confluence that comprises 100-day simple moving average (SMA) and immediate descending trend-line.

- Should prices rally beyond 126.00 on a daily closing basis, 126.80 is likely an intermediate halt ahead of confronting the 127.50-80 resistance area including 61.8% Fibonacci retracement level of its September 2018 to January 2019 declines and 200-day simple moving average.

- On the downside, 124.80 and 38.2% Fibonacci retracement level of 124.20 can provide immediate support the pair, a break of which can further drag it to 123.50 and 122.60 rest-points.

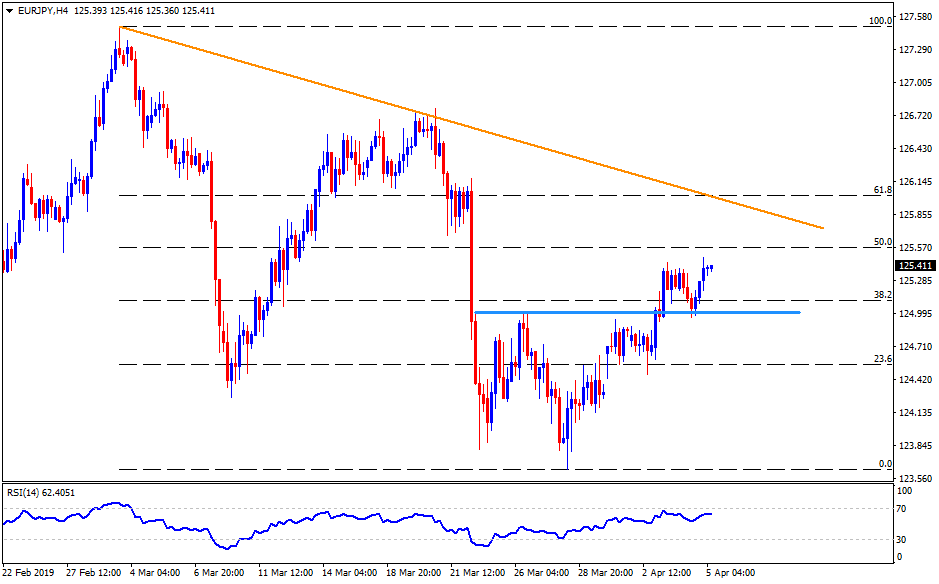

EUR/JPY 4-Hour chart

- 50% Fibonacci retracement of March month decline near 125.60 can act as adjacent resistance.

- Alternatively, 125.00 horizontal-line could be considered as the nearby support.

EUR/JPY hourly chart

- A week-long ascending trend-channel offers 125.10 and 125.90 as the closest levels to watch.

- 123.80 and 126.20 are likely additional levels on the south and the north sides respectively.