UK Election Polls: Conservatives increase lead to 12 points in critical tracker, GBP/USD positive

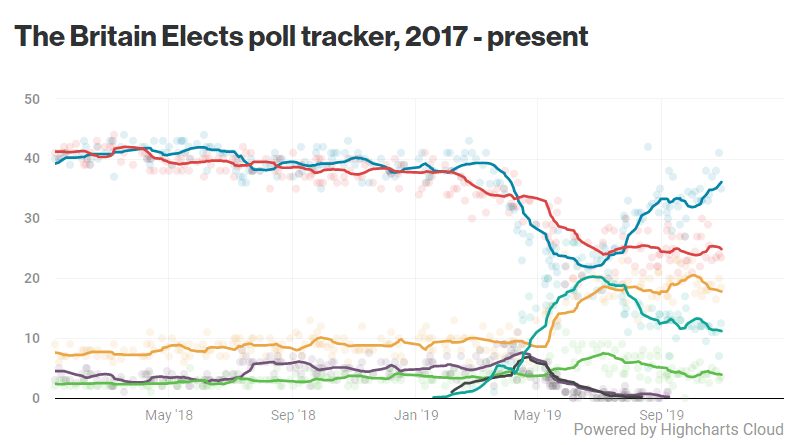

- The Britain Elects Poll Tracker has been showing growing support for the Conservatives.

- Investors will likely cheer a majority government that has a clear Brexit plan.

- GBP/USD has been on the rise but is yet to challenge the cycle highs.

Prime Minister Boris Johnson has failed to deliver Brexit on Halloween – but voters seem undeterred by the three-month extension. Britain Elects – a highly regarded website, has been showing an increase in support for Johnson's Conservatives as the delay begins.

The updated poll is showing Tories in the lead with 36.1% – up 1% since October 25 – while all other UK-wide parties are losing ground. The opposition Labour Party, led by Jeremy Corbyn, is down 0.4% to 24.9%. That puts the gap at over 12% – a considerable lead.

Source: Britain Elects

Source: Britain Elects

Jo Swinson's Liberal Democrats – who have been gaining traction at the expense of Labour, are also down, 0.3% at 17.8%.

Some of the growing support for the PM comes from Nigel Farage's Brexit Party. The new outfit – which has won the European Parliament elections in May – receives 11.2% support according to the track – down 0.2%. The Greens have shed 0.1% and their support stands at 3.9%.

Enough for a Tory Majority?

The British first-past-the-post system benefits winning parties and punishes smaller ones. While the Scottish National Party (SNP) may gain votes in Scotland, the split within the opposition – between Labour and the Lib-Dems – implies a Conservative majority. The winning Conservatives may fill more than 50% of MPs' seats with only 36%. On the other side of the aisle, the two opposition parties may lag behind with only fewer than their cumulative 42.7% share.

Best for Britain, a pro-Remain organization, has called for tactical voting – supporting the candidate, either Labour or LibDem, with higher chances to win. Will it work?

Johnson may also receive some help – from the Brexit Party. According to the Financial Times, Farage may force some of his candidates to drop out – facilitating victories for Tory candidates.

It is essential to note that voting intentions may change in the seven weeks of campaigning.

GBP/USD impact

Markets prefer certainty – even if it means a Brexit accord that may be detrimental for the UK economy. A broad majority for Johnson will allow him to ratify the exit accord he reached with the EU without any help from the opposition. The agreement ensures a transition period that finishes at the end of 2020 or even later.

That is why a Johnson victory is pound-positive.

The best outcome for investors would be revoking Brexit. Swinson has pushed for this policy at the LibDem conference. If she becomes PM, the government is set to send a letter of revocation to Brussels – without the uncertainty of a referendum. However, her chances of winning are all but non-existent.

Labour promises to renegotiate the deal. While Corbyn may end up with a better accord, the protracted period of talks, followed by a referendum which he pledged, mean high uncertainty. Moreover, the leader holds hard-left, market-unfriendly views – and the pound may plunge.

Yet perhaps the worst outcome is a hung parliament – similar to the current one.

GBP/USD has been on the rise following the latest batch of polls, and also due to the dollar's weakness. However, it has fallen short of 1.3013 – the five-month high.

If such aggregate polls continue showing a clear Conservative victory – GBP/USD has more room to rise.