Back

26 Jan 2021

Gold Price Analysis: XAU/USD bulls target daily extension

- Gold is on the verge of an upside extension on a break of weekly resistance.

- The bulls are stepping in at a 50% mean reversion on the daily impulse.

XAU/USD is making progress with respect to the bullish market structure following a period of consolidation in recovery of the daily correction.

The following is a top down analysis that illustrates the bullish bias.

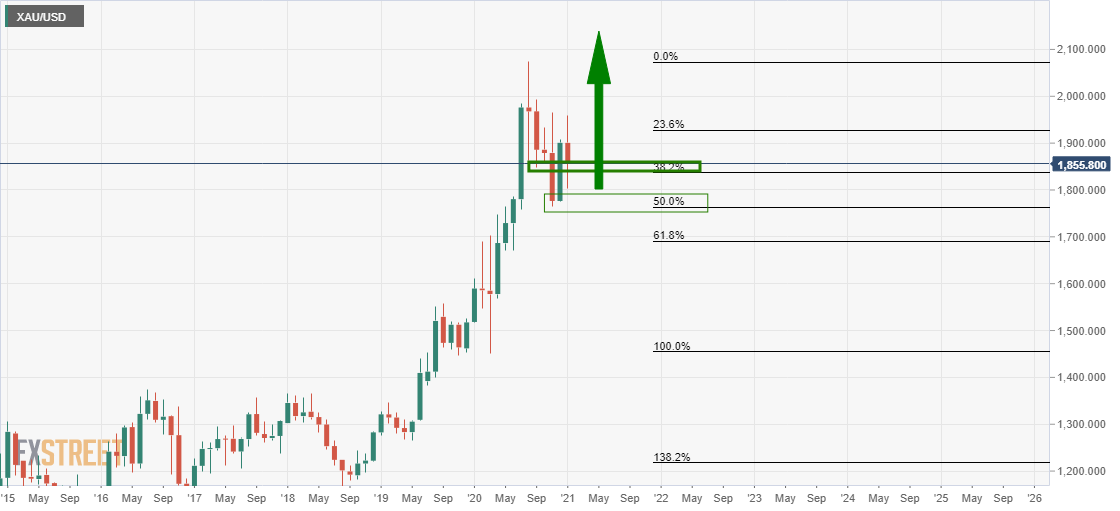

Monthly chart

The monthly chart would be expected to continue higher following the rally from a 50% mean reversion of the monthly bullish impulse.

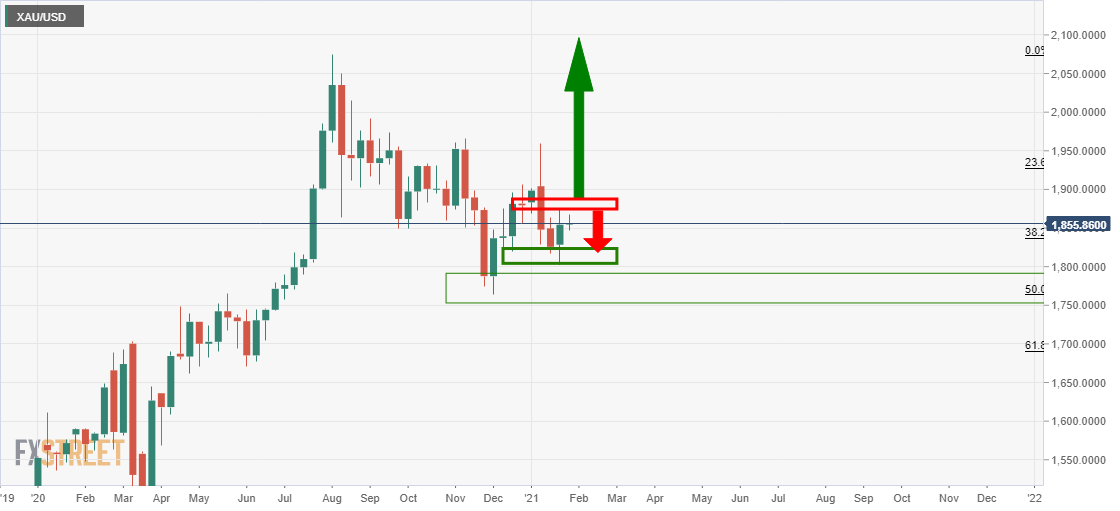

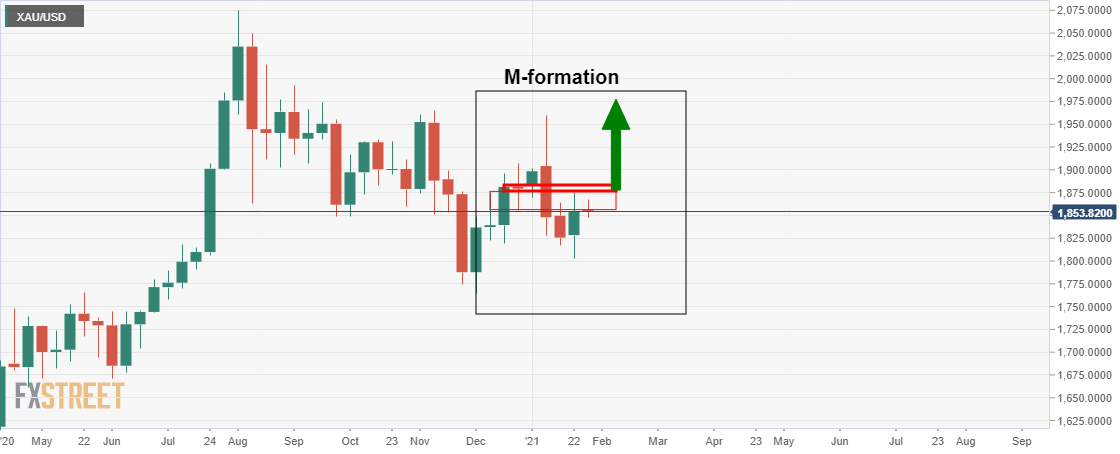

Weekly chart

The market is on the verge of a test of the weekly M-formation's neckline resistance. If the resistance holds, the focus will be back on the downside to the current support.

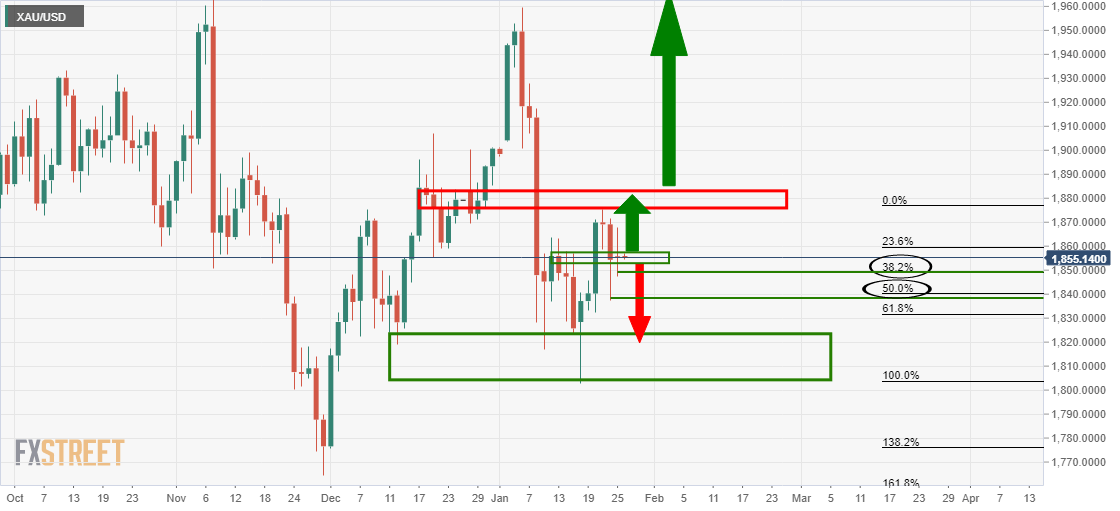

Daily chart

Following a retracement, a continuation can be expected.

In this particular case, we have seen a 50% mean reversion followed by a higher low and demand at the 38.2% Fibo which is bullish.