AUD/USD starts out Asia on the back foot, break of 0.7320 eyed

- AUD/USD is on the backfoot on Wednesday in Asia as the US dollar extends the week's gains.

- RBA was cautious and the Aussie responded in kind on Tuesday.

- US dollar has broken critical daily dynamic resistance, all eyes on ECB.

AUD/USD has had a poor post-Reserve Bank of Australia session overnight, with the price falling to a low of 0.7374 and below the pre-Nonfarm Payroll daily lows of 0.7395.

The Aussie picked up a bid last week to score a high of 0.7478 after a major disappointment in the NFP data.

However, the dollar bears have scurried ahead of this week's European Central Bank meeting, cautious of a less hawkish than expected outcome.

This follows a cautious tone from the RBA on Tuesday whereby their decision not to walk back its timeline for tapering was met with bears pouncing after the volatility settled down.

The RBA QE purchases are now running at A$4bn/week from this month onwards compared to the earlier rate at A$5bn/week.

However, the Bank signalled that they will continue bond purchases at A$4bn/week until at least mid-February 2022, from their earlier November 2021 review.

However, the RBA acknowledged the poorer-than-expected economic outlook and decided to hold the reduced QE pace of A$4bn/week until at least mid-February next year.

Time will tell if their narrative that the Delta outbreak is only "interrupting" the recovery is right. meanwhile, investors are staying on the sidelines and keeping a watchful eye.

DXY breaks critical dynamic resistance

All eyes on ECB, how hawkish can you go?

This week's ECB will be key for the direction of risk.

The Aussie tends to track the euro and US stocks, and of course commodities.

The US dollar will depend on the outcome of the ECB as to how hawkish it is, for the euro is heavily weighted to the XY, so any significant shift in the DXY will affect the Aussie.

More on this on the following articles:

EUR/USD: ''The first P in PEPP stands for Pandemic, not Permanent''

US dollar bears denied a free lunch post-NFP fall-out, US yields surge

US Coronavirus Delta spike: The caveat to US dollar strength and the Fed's max employment goal

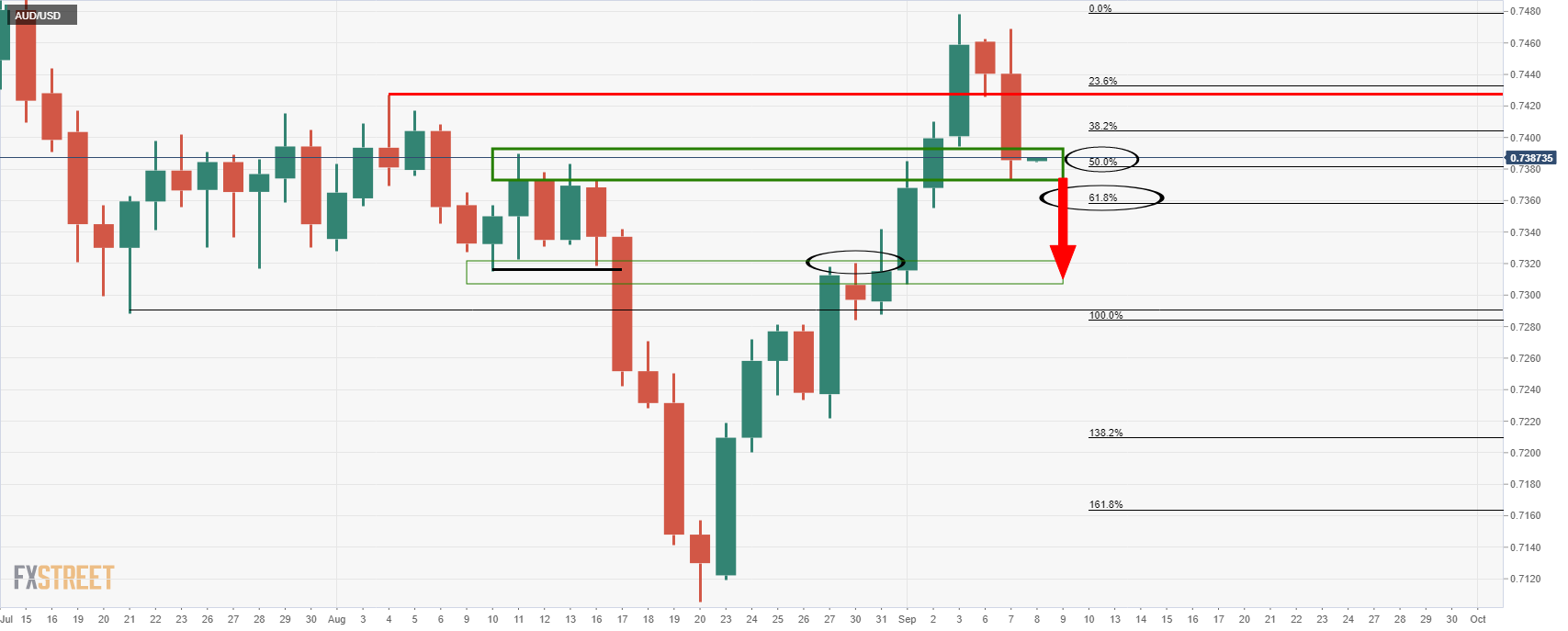

AUD/USD technical analysis

The price has broken key levels to the downside from a daily perspective.

Bears will be keen to see a test of the 61.8% ratio ahead of the 30 Aug structure around 0.7320 and near 10 Aug lows at 0.7315.