USD/INR Price News: Indian Rupee vulnerable to a significant correction

- USD/INR is staying put between familiar ranges of consolidation.

- The US dollar is changing hands between the bulls and bears in equally typical levels.

As illustrated below the price has been accumulating around 74.20/40. However, at this juncture, it is too premature to know if this is leaning with a bullish or bearish bias.

Nevertheless, the bulls could be encouraged to move in to clean up some of the imbalance of the recent price run, on a break of 74.60 in the coming days. This exposes the 38.2% Fibonacci retracement area on the daily chart near 75.10:

-637771237879780482.png)

On the other hand, if the US dollar cannot catch a bid on the hawkish Federal reserve sentiment, then there is room for further downside into the imbalances of rice below the near-term dynamic trendline support. These areas come in at between 74.10 and 73.90.

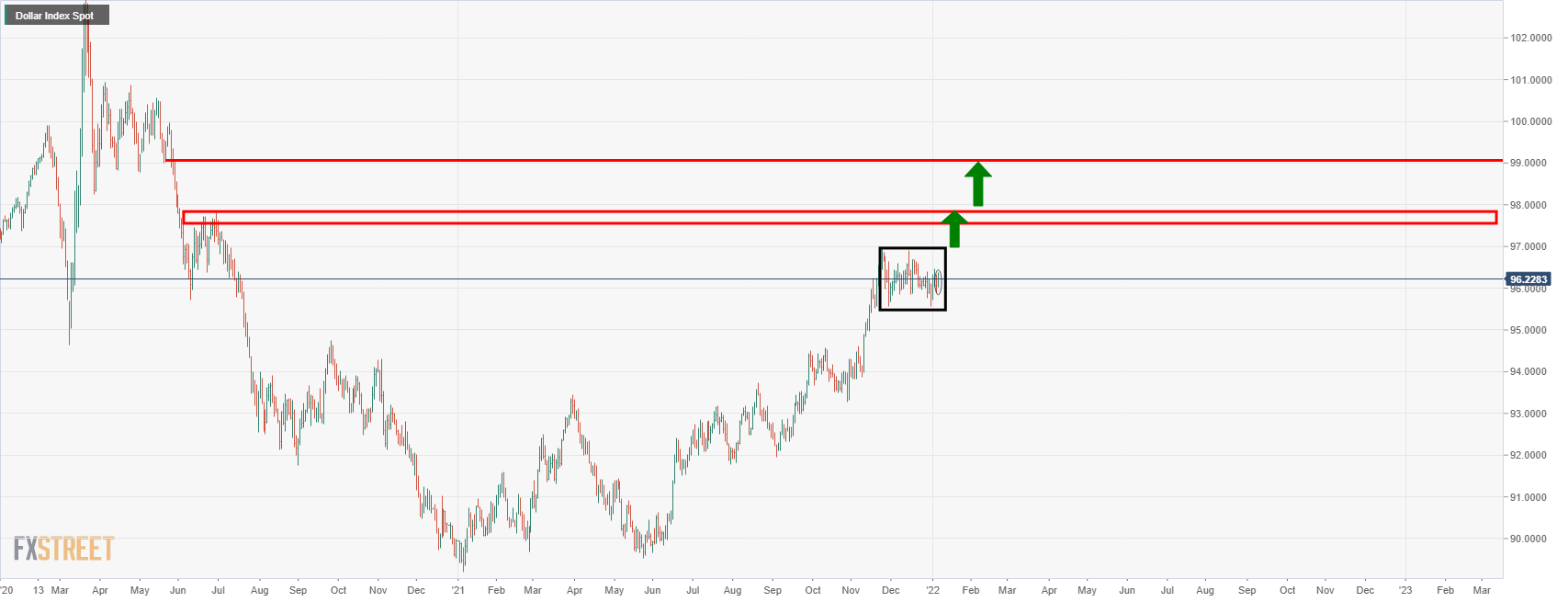

DXY daily chart

The US dollar needs to break out of this accumulation phase and beyond the highs of 97 the figure. In doing so, a fast trip to 98 and 99 could be on the cards for the coming weeks which would take on the 38.2% Fibo target and beyond in USD/INR. This would expose the 50% and 61.8% ratios that align with liquidity areas of 75.40 and 75.65 as old highs:

-637771245117293510.png)