EUR/USD remains bid and flirts with 1.0250/60 ahead of key data

- EUR/USD extends the rebound to the 1.0250/60 band on Friday.

- EMU Flash GDP, CPI next of relevance in the region.

- US PCE, Consumer Sentiment will be in the limelight in the NA session.

The single currency remains well bid and motivates EUR/USD to revisit the key resistance area around 1.0250/60 at the end of the week.

EUR/USD now looks to EMU, German data

EUR/USD is up for the third session in a row and it has been gathering traction since the FOMC event on Wednesday, particularly after investors perceived as dovish some comments from Chief Powell, who poured cold water over the probability of further large rate hikes in the next months.

In addition, the greenback sees its downside accelerated on Friday in response to poor flash GDP figures, which suggest that the US economy has entered a technical recession in the second quarter.

In the German cash markets, the 10y Bund yields manage to regain the smile somewhat following multi-week lows recorded in the previous session.

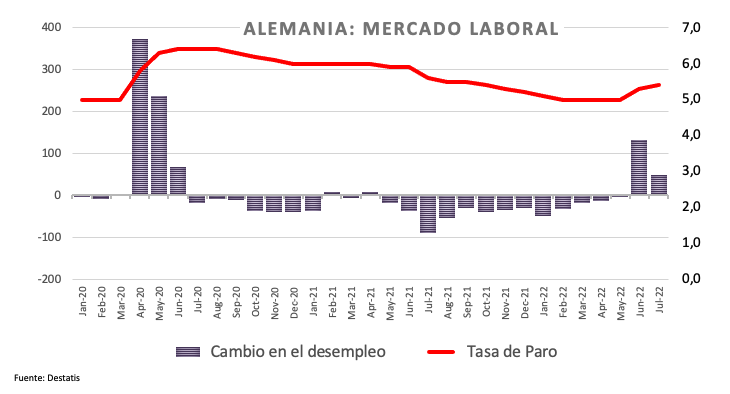

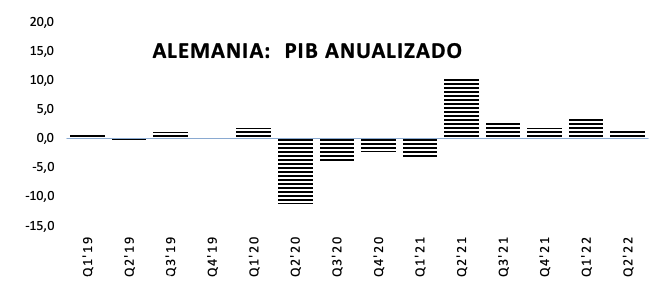

Data wise in Germany, the Unemployment Rate edged higher to 5.4% in July and the Unemployment Change rose by 48K persons in the same period. In addition, flash GDP figures now see the economy expanding 1.4% YoY and came in flat vs. the earlier quarter.

Later in the session, the pair is expected to face some volatility in light of the release of the advanced inflation figures and Q2 GDP results in the broader Euroland.

Across the pond, the focus should be on the inflation figures measured by the PCE and the final U-Mich Index.

What to look for around EUR

Euro bulls regain the upper hand and encourage EUR/USD to challenge the upper end of the range around 1.0250 at the end of the week.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerges the so far increasing speculation of a potential recession in the rMedium (h3)egion, which looks somewhat propped up by weaker sentiment readings and the renewed downtrend in some fundamentals.

Key events in the euro area this week: Germany Unemployment Change, Unemployment Rate, Flash Q2 GDP, EMU Flash Inflation Rate, Advanced Q2 GDP (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Performance of the economic recovery post-pandemic in the region. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is gaining 0.35% at 1.0232 and a breakout of 1.0278 (weekly high July 21) would target 1.0432 (55-day SMA) en route to 1.0615 (weekly high June 27). On the other hand, initial contention emerges at 1.0107 (weekly low July 26) seconded by 1.0000 (psychological level) and finally 0.9952 (2022 low July 14).